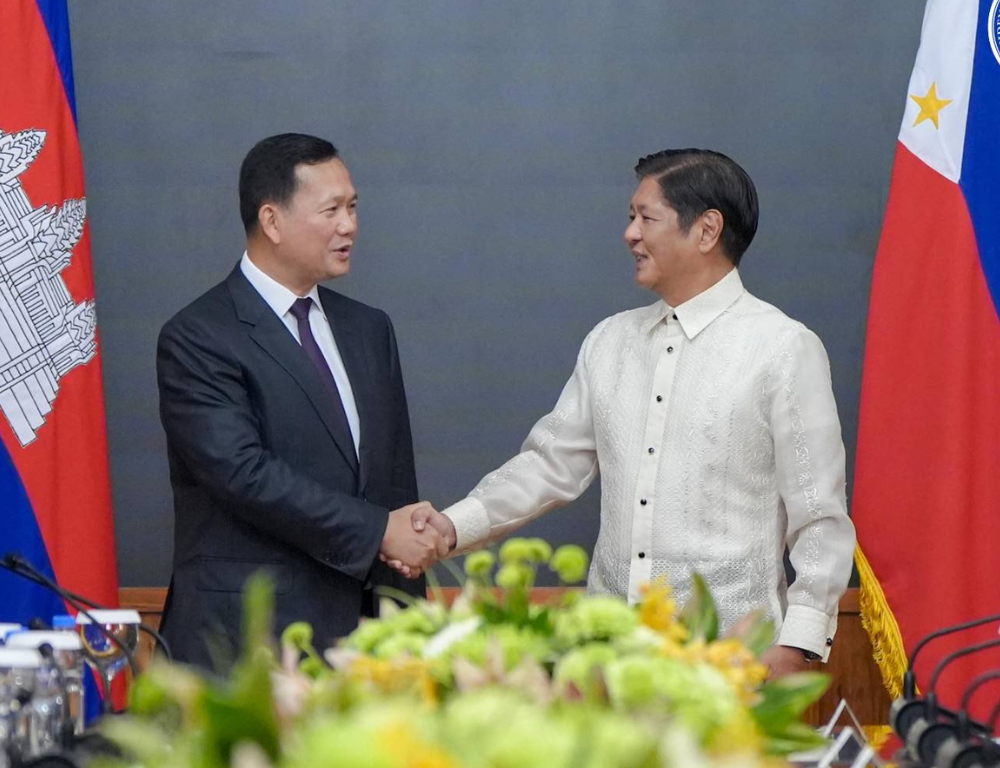

The Philippines and Cambodia have signed a double taxation agreement (DTA) to boost business confidence, increase trade, and spur economic growth between the two nations.

The DTA was signed for the Philippines by Finance Secretary Ralph G. Recto, and for Cambodia by Deputy Prime Minister and Minister of Foreign Affairs and International Cooperation Prak Sokhonn on February 11, 2025.

The signing was witnessed by President Ferdinand R. Marcos, Jr. and Prime Minister Samdech Moha Borvor Thipadei Hun Manet.

“[W]e welcome our formal cooperation on the avoidance of double taxation and the exchange of best practices in competition law that the Philippines and Cambodia both consider as critical to entice and facilitate greater bilateral investments and economic activities between our business sectors.,” President Marcos, Jr. said during the ceremonial event.

“The signing of this DTA is a crucial step towards improving the integrity of our tax system. By eliminating tax barriers and ensuring a fair and transparent framework, we are not only attracting greater foreign investments into the Philippines but also reinforcing our trade ties within the region. This will position us as a strong and reliable economic partner,” Secretary Recto said on the sidelines.

The DTA is designed to eliminate double taxation on income earned in the Philippines and Cambodia, prevent tax evasion, and enhance economic cooperation, in line with commitments under the ASEAN Forum on Taxation.

It is expected to reduce fiscal barriers and stimulate bilateral trade and investment, contributing to stronger economic ties between the two nations.

Specifically, the agreement covers various aspects of taxation, including income from business profits, dividends, interests, royalties, capital gains, and other sources of revenue, ensuring a fair and efficient tax framework for businesses and individuals operating in both jurisdictions.

It also includes the exchange of tax information and dispute resolution mechanisms in line with the Anti-Base Erosion and Profit Shifting (BEPS) and tax transparency initiatives and standards.

The agreement was finalized following three rounds of negotiations between the two countries. The third and final round was completed in Manila in April 2024.

This initiative between the two nations is set to take effect following ratification by the respective legislative bodies in the Philippines and Cambodia.

The signing of the DTA was part of Prime Minister Hun Manet’s two-day official visit to the Philippines on February 10-11, 2025 to strengthen both nations’ relations and advance collaborations in key sectors as well as regional and multilateral cooperation.

Secretary Recto served as President Marcos, Jr.’s Cabinet-Secretary-in-Attendance during the official visit. (DOF)