Local, foreign business leaders say investor confidence is back and thriving

Local and foreign business groups are welcoming the robust performance of the Philippine stock market in recent days, viewing it as a sign of renewed confidence in the country’s economic fundamentals and governance under President Ferdinand R. Marcos Jr.

The strong rebound being shown by the Philippine Stock Exchange index (PSEi) “is proof that confidence is returning and fundamentals are reasserting themselves,” the Federation of Philippine Industries said on Thursday, January 5.

On February 3, the PSEi surged by 104.88 points, or 1.67 percent, to close at 6,401.96 — the highest level since January 19, 2026.

The rally erased market losses triggered by concerns over corruption in multibillion-peso flood control projects flagged in President Marcos’s July 2025 State of the Nation Address. Analysts say the rebound reflects not only improving market conditions but also investor approval of the government’s steady and rules-based approach to economic management.

Dr. Jesus L. Arranza, PFI chairman emeritus, attributed the market’s resurgence after months of sluggishness to the “calm and focused” leadership of President Ferdinand Marcos Jr. amid “all the political noise surrounding the flood-control scandal.”

“President Marcos is doing the right thing by staying focused on the work…. His calm, steady demeanor signals that he’s in control and well on top of the situation, and markets respond to that kind of leadership. Calmness begets calmness,” Arranza said in a statement.

“The PSEi’s strong rebound shows confidence is returning and fundamentals are reasserting themselves. For the business community, the message is simple: keep building, keep investing, and keep contributing to economic growth,” Arranza said.

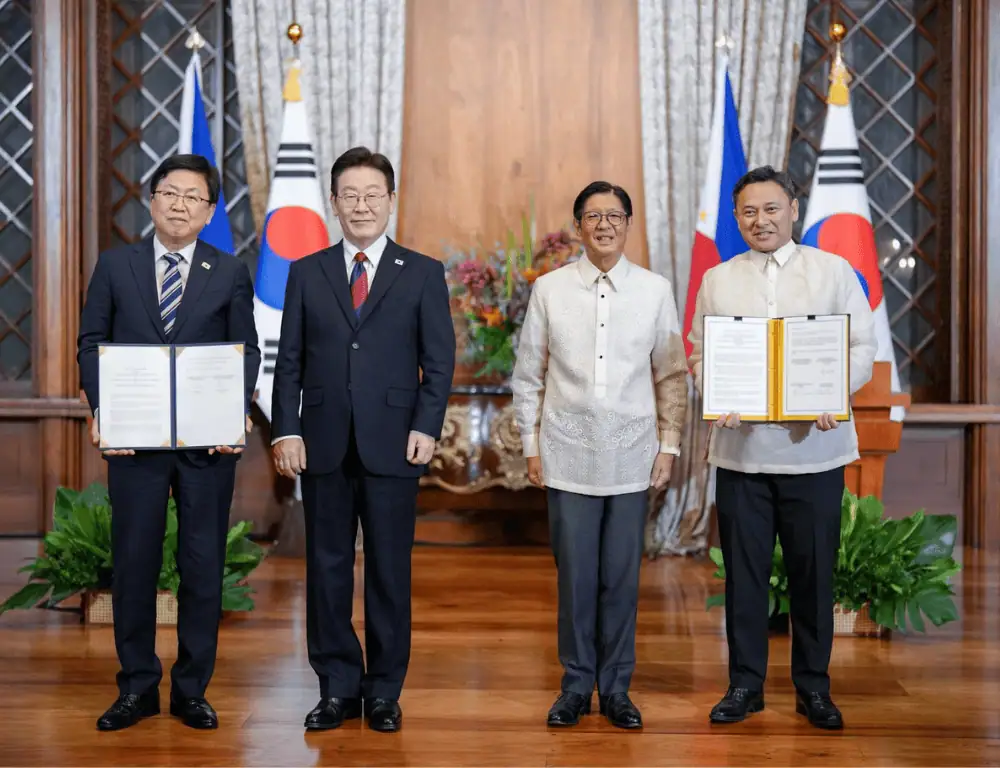

Foreign investors are taking note as well. The British Chamber of Commerce of the Philippines (BCCP) welcomed the record-breaking surge and commended the government’s efforts to stimulate economic activity, manage inflation, and pursue policies aimed at long-term growth.

“These developments set a positive tone for the Philippines’ ASEAN Chairship and further position the country as a strategic trade and investment partner for its regional and global peers such as the UK,” said BCCP chairman Chris Nelson.

The chamber also reiterated support for key legislative measures such as the Cybersecurity Act, Digital Payments Act, and Blue Economy Act, which strengthen digital infrastructure, enhance financial inclusion, and promote sustainable growth.

Economists note that the market recovery is supported by both policy and external factors.

The Department of Finance’s announcement of a ₱1.4-trillion government spending program for the first quarter of 2026, coupled with gains in U.S. equities, easing global oil prices, stronger U.S. manufacturing data, and a stable peso, helped lift investor sentiment.

RCBC chief economist Michael Ricafort said the rally fully wiped out market declines caused by flood-control corruption concerns, signaling renewed investor trust in Philippine governance.